We tried to buy another newsletter.

We failed.

Here’s what happened.

Here’s what we’d do differently.

Here’s why we want to buy one.

Here’s why if you’re looking to sell a newsletter we are MFing buying….

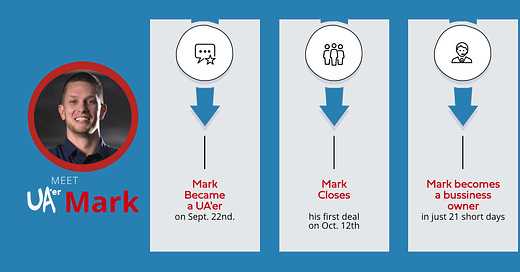

Also - if you don’t know anything about buying businesses you might want to take this course from Unconventional Acquisitions on how to buy businesses. They gave us a Grow Getters discount of 25% (use code grow25 on anything). Thanks homies.

We got an offer to acquire us.

That was cool. So we thought about it, but wanted a bit more juice. Aka - we’re greedy and wanted more profit.

But the only way to do that is to increase profits or subs materially. Between the three of us we don’t have the time to do that kind of push. So we thought, why build when you can buy?

So we did what any respectable business acquirer does:

We donned our Private Equity bro starter kit, and began telling everyone we know we are “looking for acquisitions,” and hit the road.

With Patagonia vests perfectly situated (although Ilona and I are not exactly sure about this look on top of our crop tops?), we went searching.

We started checking out our favorite platforms & newsletters and found a massive list of defunct newsletters on Substack.

After emailing 97 of the Substack owners who had closed their shops we received a whopping 3 replies.

But HOT DAMN… one of them wanted to play.

Acquisition #1 Target Stats:

18k subscribers

30% open rate

It's defunct right now and non-monetized (used to make 50k a year supposedly on Patreon)

In similar vertical as Grow Getters (aka synchronicity)

PROBLEM: The guy wanted $100k for it. Hmmmm, with no revenue and no emails sent for 12 months - Olman’s response:

Ok not to be dissuaded, we found round two. This time not looking at defunct and instead, searching for newsletters we were already fans of in our space.

We found a newsletter and community we REALLY liked…

And still like to be fair. It was tiny, under-monetized and we thought we could blow it up without having to build out the back-end.

Acquisition #2 Target Stats: (Changed slightly to protect our homie)

Metrics:

Subs: 400

8 months of history

side hustle for the founder

Membership fee: $20-80 a year

Members: 300

MRR membership: 800

Sponsorships: $1000 MRR

MRR total $1800

ARR: $21,600

Expenses: $400 MR

Annual expenses: $4800

SDE: (seller’s pay) tough because she doesn't pay herself a salary

Annual profit: $21,600 - $4,800 = $16,800(ish) annual profit (w/o substracting salary)

Our Plan for Growth:

We’d get it listed on AppSumo and 10x the subscriber base. Ilona is a content queen and can give the site, product and email strategy an uplift. Olman can leverage partners for collaboration. We could partner with SendFox. Codie can get it into Contrarian Thinking and apply our models for content businesses.

Optimization ideas: We didn't want to do this unless we could grow the business to a value worth a couple of hundred K at least.

Step 1: Growth moves:

Convert 10% of 5,000 GG email list to the new membership

Probably means we add 500 x $79 to the bottom line (right off the bat) = $39,500 to his bottom line (so double revenue)

Start highlighting in Contrarian thinking (100,000 subs) - imagine we get another 100-500 or so - if we just assume 200 from that it's another $15,800 which means = ARR $55,0300 just with those two moves

Then we do an AppSumo deal = 1,000 new subs so $50k in revenue take home

So with us just listing on CT and GG transition we get it to $55k in ARR

- then add AppSumo amount of $50k = $105k (think we can do that inside of a year)

- then I say when we hit $100-250k in profit, we can think about listing to sell for $400k-$1M depending on where we're at

Step 2: New revenue lines:

Increase her prices all to $79 a year for service

Add a mastermind and course for higher dollar items

Add some info products

upgrade the mastermind/membership group to have a premium option that is multiple $1k a month eventually which would had another $100k-1M to ARR

What We Offered:

We wanted to merge and pay into the Hold Co to acquire. We invest to show her we have skin in the game, but more than that we were going to transition over our 5,000 person Grow Getters email list (all people interested in newsletter growth), and put her into Contrarian Thinking (100k+ newsletter) and get her on the AppSumo marketplace a few different ways with Olman and Ilona.

So our goal would be to take her $20kish in revenue and up it to $100k+ this year. Then we could either keep growing it and cashflow on it or sell it. Happy with either. We mainly just wanted to write about it the experience. Here were our offers:

Option 1: Offer Cash + Services

$10k cash infusion (we give you that money right now), we split the business 50/50, and immediately start introducing and transition the 5k subs from GG to you, we split the profit that comes out of it with distributions where you get 50% and we get 50% quarterly.

Option 2: Offer Cash + Services + Founder Keeps Equity

$5k cash infusion, we split the business 50/50, and immediately start introducing and transition the 3k subs from GG to you, but here instead you keep all the current revenue you are making, anything over it going forward we split 50/50 just as in the above option just less money upfront. If we don’t hit the milestones we mentioned then you can have a clawback where you clawback your equity and it’s a non-issue.

Option 3: Offer 3x Multiple of Revenue & We Buy Outright

She had an offer for an outright acquisition of 3x revenue. We said we’d match it.

What happened?

We lost.

The founder ended up not selling and choosing to grow it. We could have invested outright but felt that as a side hustle it’s not a 100x business to justify a passive VC investment.

We’re still looking for deals. But we lost that one.

Lessons learned:

People get really attached to their sales price - so optimize for that

We had to go back and forth on email A LOT due to timezones, that’s a deal killer

Now if you are asking yourself WTF would you buy a newsletter? Here’s an excerpt from Codie on the why… holler in the comments if you want to sell or buy, we got you!

Learn more about acquiring newsletters and businesses HERE. Use code grow25.

BUYING A NEWSLETTER:

The How, The Why, The WTF

My business motto; Why Build, When You Can Buy. I love the buying model as the foundation to anything I want to build upon. Why? You get to start on third base. It’s so much easier to innovate (for me) when I have cash to work and risk with.

My formula for acquisitions: Buy, Build, Cash Flow Forever.

But, why Newsletters? Wrote about this before here but what I realized is at Contrarian Thinking each subscriber is worth about $2.9-$3.29 per year to me.

So with 100k subs, if I monetize I can generate $290-329k a year PROFIT. (Model below).

Um, yes please.

So - if I can generate that off my own subs why couldn’t I buy others, discount them, and juice up the return and subscription much faster than by adding a few hundred emails a week?

BUILD VS BUY

Y’all subscribers play hard to get when you have to do it organically. Instead of tracking you down 1 by 1, if I buy a newsletter, I get to grab a big huge net, throw it over a ton of ya and lovingly bring into the mix tens of thousands. THAT is the power of acquisitions! (Disclaimer - you have to be thoughtful of rules on email opt-in’s but that’s easy).

Let’s break this bad boy down, why I love newsletters:

#1 Baby You Got Some Good Looking Margins

Newsletters are my favorite type of small businesses; high margin, low people businesses. Margins in newsletters for independent creators can be as high as 90%, as is rumored on Stratechery, or around 80% which is what they are for Contrarian Thinking. On average after talking to 10 different newsletter owners, most independent operators have margins of 75-80%. Those who have a team are widely variable, NY Times (subscription media at 8.8% margin) or the average of around 50% margins.

#2 They’re Benjamin Buttons

As Scott Galloway says, any business that gets more valuable as it gets older follows the Benjamin Button formula. With newsletters each subscriber you have comes with data, and if you’re good, they come into your flywheel where you create ancillary products around your newsletter to sell them once and profit continuously.

#3 You Can Turn Around & Sell ‘Em For Solid Multiples

While I don’t like to sell cash flowing assets unless they’re a lot of work to run, not only can you sell newsletters but also many are doing it at solid multiples.

Morning Brew Getting Acquired for $75M by Business Insider (doing $20M Profit purportedly)

Axios, politics newsletter launched in 2017, reportedly $58M ARR

The list goes on, Trends did a great piece on these (worth the signup - click here and you get $100 off for CT homies).

#4 Less Risk Than Other Digital Assets

Stefan Van Imof, a bud of mine from Flippa, said it perfectly in newsletter acquisitions:

Unlike with other digital assets, there’s no real learning curve, no messy code to transfer, and no chance Google will whack your SEO with a core update. All the data around subscribers, open rates, and click rates is either out in the open or easily verifiable. Costs to operate are minimal, and revenue streams are abundant. Oh, and you don’t need to be highly technical to get going. Brilliant!

#5 Usually Under Monetized

They often haven’t optimized all the ways they can profit. $0 in profit ain’t abnormal. Which is perfect for us as buyers who know how to monetize. So I value them at what they’re currently making but I model them out based on all the additional revenue lines I’d add. How you like them apples?

WE DON’T BUY AT HIGH MULTIPLES

We want deals. Here’s how.

What Are They Worth?

Valuation Method #1: Profit

Let’s make this super easy. I’m in private equity, many in this industry make a living out of overcomplicating acquisitions. Here’s the secret to businesses that do less than $5M in rev and are standard businesses, by and large… they’re all worth 2-3x profit. Period. Don’t EVER buy upside potential when you’re buying for cashflow You can model growth potential for yourself but don’t buy off it. Try to sell for higher YES, but don’t buy for higher.

Now you can value newsletters like the Duuce CEO here, or take a more complicated model like Avoid Boring People does here. But I wouldn’t waste your time when you’re in buying mode on a super small scale. Profits x 2-3 = Your Purchase Price.

Valuation Method #2: No Profit?

Went back and forth with Stefan again on this one, I think he has it right. Using cost to acquire a new email i.e. replacement cost as your valuation metric. Look at your newsletter/business and figure out what it costs you to acquire an email:

If your average acquisition cost is $2 per subscriber, then to you, a newsletter with 10,000 subscribers would be worth $20,000. And if you paid exactly $20,000 you’d basically just be saving yourself time and energy.

It may be worth more or less to someone else. And this market is probably too young to have a generally accepted benchmark CPA. But at least with this method you know if a newsletter is priced in the same ballpark.

However those emails haven’t opted in to you, so I’d have a hefty discount on the price since they won’t all convert as high on your offer or to join your list.

Valuation Method #3: 50% Discount to Your Monetization

This is how I’d do it. Look at my business, determine how much I can monetize each email I have, then discount the conversion. I’d assume a 50% drop off rate, giving me room to buy a newsletter with no profits on it at all at a massive discount from the standard 3-5x.

Hypothetical example:

10,000 subs, $0 profit.

Let’s say may replacement cost is $2

I could pay $20,000 for that newsletter

Or I could look at my monetization ability and take $2.9 I mentioned above and discount 50%

End up at a price of $1.45 an email

Or $14,500 for that email list. Is that enough of a discount? (HMU if you have experience with that).

Remember all this is for us buds—when you’re negotiating don’t give them the keys to castle. Make a man wait a bit, ya know? Wink.

If I Was to Value Contrarian Thinking

Nothing like leading by example, how about I do the opposite of the aforementioned line and open up this kimono? Here is how I monetize CT.

First assumptions: IMHO you can’t monetize newsletters well until you hit 20,000 subs. Right about then is when you’ve hit enough momentum (and given enough value) to be able to ask for money. So I modeled out my revenue with 20k and 100k coming into 2021. This is all assumption laden and super simplistic, but here’s a framework. This is a literal model I use to think about the business as very simplistic models keep you from believing your own total b*s* guesstimates. Cough cough, I mean projections.

That said, this is SUPER CONSERVATIVE, ugh gross did I just say that? I hate when entrepreneurs tell me their model is conservative when investing. Shhh… don’t tell ‘em.

My Revenue Lines:

Info Products - I first sold Gumroad guides. They weren’t a focus and super niche (How to Get Into Cannabis) so assumed .75% conversion (meaning if I have 100 subs .75% of them would buy).

Premium Membership - This is what Substack does, allows you to charge for a premium version of your newsletter. They say assume 10% conversion on your subs. I think that’s too high, because I believe no one, so I assumed 2%. I set it as a $10 monthly charge.

Ad Revenue - To go search out sponsors and ads seems laborious and a poor ROI until you’re larger, or hire someone. Unless hey, HMU if you want to sponsor CT and your product/service is RAD. So the model assumes you don’t start for a few months after launching. I assume an ad price of $500 per 20k subs based on a CPM of $25.

YouTube Ad Revenue - I’m going to experiment on YouTube w/ CT so you can ignore or add this, but might be interesting revenue line to add.

Affiliates - Which means making money off listing other people’s products, and taking a commission. Like Unconventional Acquisitions. I will likely add other products but I’m an over-vetter, under-monetizer on CT, so I haven’t found products I feel confident standing behind yet. You could probably add another $1-2k a month here on 20k subs.

Other revenue options: e-commerce (first easy step would be merch), community forums (UA has a mastermind), podcasts, consulting etc.

With 100k subs I can generate revenue of $549k and $329k profit :) Not bad.

I’m sure there is wide variance here but that’s the thing about models… they’re all made up. If my numbers are right I could probably sell for 5x multiple of profit in 2-3 years. However, given my face is on here (eek) I’d probably need to diversify, add more writers, and get rid of the key “wo-man” risk or shackle myself to the buyers foreverrrrrrr. Thanks but no thanks.

But instead I’ll just follow my motto:

Buy

Build

Cash Flow Forever

Alright, YOU ARE A GENIUS. I bow down and now want to buy newsletters.

What Makes A Newsletter Attractive to Me:

Picture’s worth a thousand words. What kind of newsletters would I buy? Right now I’m in discussions with one that has:

250k emails

50k monthly page views

50k Facebook group

Finance niche

5 year history

$8k a month profit or $96k a year

They want $75,000 for it (that’s a .08x multiple). If it all checks out I’m highly likely to acquire this one. Probably for a discount still as it’s only 1 year old. HTF did they grow that all in one year?!?

The key tenants are a list of 10k+, in business/finance niche, ideally 3-5 years old, 50k+ page views, and profits or not.

But don’t you worry, I’ll go ahead and lift that kimono for you naughty girls and boys again when I find my prince charming…

Speaking of finding…

How to Find Newsletters:

Listen Houston, we have a small problem. The market is very very shallow. When I screened for all the parameters above across marketplaces I found less than 15 who were even marginally interesting.

That said, first start with marketplaces:

Duuce is site exclusively for buying & selling newsletters. Had a nice chat with Jonas, the founder of Duuce and while it’s still an MVP I like the idea a lot. Probably why he did so well listing on Product Hunt.

Flippa - online biz marketplace.

Blogs for Sale - Lord is this a terrible user interface, but two sites in here are interesting albeit very overpriced so I pinged them to see if we can whittle those down.

Second spot, Facebook groups related to newsletters, email marketing etc. I’m posting this in them: “I’m looking to buy a newsletter, blog business with over 10k+ subscribers and some traffic. Please let me know if interested.”

Third spot, pinging large(ish) Instagram and Facebook groups in my niche to see if interested in selling with the same verbiage above. Will report back but so far 10 requests sent 7 responses received. Yup, it’s early days here and I think we’re all going to wish (just like with websites) we had snapped more up.

After all, when’s the best time to plant a tree? 10 years ago, second best time? Now.

Click here to learn about how to acquire businesses.. use code grow25 for a hot 25% off deal.

Keep on growin’ or buying,

Ilona, Codie, & Olman